Car manufacturers have long seen electric cars as a niche market. Today, they seem to have taken a new approach to electrical mobility. But in order to definitively attract car owners, they are faced with three challenges: improving battery range and charging time, expanding the network of charging stations and making the purchase price more accessible.

Boosted by government measures, sales are taking off...

Electric car sales represented a mere 1.5% of global new car sales in 2018. The fact remains that electric cars are struggling to attract car owners. However, since 2014 and “diesel gate”, the market seems to be ready to take off. The number of electric cars driven worldwide has virtually increased fivefold over three years to reach 1.2 million sales in 2017(source: International Energy Agency), a figure up nearly 60% on 2016. The trend seems to be continuing in 2018 with a 66% rise in the first six months of the year (source: EV-volumes.com). “A few years ago, we didn’t know whether the automotive sector would adopt electric power. Now we are looking at what we can do to speed up the movement”, reveals a manager at Umicore, a manufacturer of battery materials. And specialist forecasts are increasingly optimistic: research by Roland Berger consultancy announced 100 million electric vehicles sold around the world in 2035. “All car makers are now committed to the transition. There will be no going back”, confirms Laurent De Vroey, head of the electric mobility laboratory at Laborelec (Engie Group).

8 leading countries

There are inequalities in the market, however: eight countries—China, the USA, Japan, Norway, the United Kingdom, Germany, Sweden and France—alone represent 90% of global sales. And China makes up nearly 50%. In July 2018, 3.3% of cars on Chinese roads were electric. Norway does even better on its scale: every other car sold in the country in 2017 was an electric car. However, in certain European countries, sales are struggling to top a few hundred units.

In France, less than 1.2% of new car sales are electric. This still gives our country one of Europe’s largest fleets of electric cars. But the French car industry is not letting up because it is expecting five times more sales of electric cars by 2022. “Tomorrow’s cars will most certainly be electric”, Renault confidently asserts.

The battery is the central issue

To boost sales, car makers are counting on progress in lithium-ion battery technology. Certain car makers—Nissan and its new Leaf, Kia and its Niro or Hyundai and its Kona, for example—are thus announcing access to long distances in 2019: up to 250 km on interstate highways and about 400 km on other roads, thanks to lithium-ion batteries with capacities in excess of 60 kWh (kilowatt-hours). The electric car battery market is currently dominated by Asian groups including BYD and CATL in China, Panasonic in Japan, and LG Chem and Samsung SDI in South Korea. But in Europe the counterattack is shaping up at Saft in France, Varta in Germany and Northvolt in Sweden. And in the mid term, new technologies should start emerging, like the solid-state electrolyte battery which, on paper, promises a range in excess of 600 km and charging times of only a few minutes. It is not expected to be on the market before 2025, however.

No electric car without a network of charging stations

According to a 2018 report published by France Stratégie, the network of charging stations has always been the stumbling block of electric mobility. To meet driver demand, the worldwide network of public charging stations needs to be multiplied by at least 30 in the next 15 years. China intends to have twenty times the number of self-service charging stations in the country as of 2020, with the goal of one charging station for every electric car on the road. California’s road map also includes the wide-scale deployment of charging stations before 2025.

In France, the number of self-service charging stations will increase from 25,000 today to 100,000 in 2022. These charging stations will be installed by local energy syndicates with financial backing from the government—and local authorities—and be based on a plan aiming to distribute them evenly and according to the constraints imposed by the electricity grid. In addition, it is required by law to equip parking lots in new, industrial and commercial buildings and collective residences. Moreover, financial aid (tax credit etc.) is offered by the government—in conjunction with energy specialists—to private parties (individuals, co-owners or companies) wishing to install a charging station on their parking lot or at their home. Simultaneously, car makers and other private operators (Total, Shell, etc.) are rolling out deployment programs—for ultra-rapid charging stations in particular—on interstate highways and in service stations.

The indispensable boost from incentive policies

In terms of running costs, electric cars appear to be cheaper than the internal combustion engine: depending on the country, its fuel budget is 6 to 9 times lower than that of an internal combustion engine, and maintenance costs are much lower. But even if the price of lithium-ion batteries has already gone down considerably, from $1,000/kWh in 2010 to $209/kWh in 2017, the issue of the purchase price remains an obstacle. A Nissan Leaf—the most popular electric car in Europe—still costs nearly €15,000 more than an equivalent internal combustion engine. Analysts believe the electric car will only become competitive when the price of the lithium-ion battery comes down by half. And this is not expected to happen before 2025 (Bloomberg New Energy Finance).

In the meantime, a recent report published by the International Energy Agency confirms that government policies have the power to influence purchasing decisions and car maker strategy. This is why in three regions of the globe, electric car sales now exceed 10% of new car sales: in the Chinese cities of Beijing, Shanghai and Shenzhen, in some 30 California cities and in Norway.

China’s industrial strategy

In 2017, China registered over 600,000 electric vehicles compared to 15,000 in 2013. China now represents nearly half of the world’s private electric car market. This is the result of a policy aiming to both reduce urban pollution and boost the local car industry, in particular through large subsidies—which can cover up to half of the purchase cost—reserved for the purchase of… Chinese cars! Then through indirect benefits. In Beijing, registrations are strictly controlled to bring down pollution levels in the Chinese capital. They are attributed by a lottery system and an estimated one million people are waiting for the winning ticket. The winners will then have to pay 90,000 yuans (approximately $13,000) for their plate, i.e., more than the price of the car! But those who opt for an electric car are exempt from this requirement. According to the government, this policy has not brought the expected results, so new measures are being taken. This means that by 2019, the car makers present on the Chinese market must sell a minimum of 10% of electric or hybrid cars. A figure which is expected to increase to 12% in 2020.

The California quota model

This quota model is very similar to the one implemented in California during the 1990s. An incentive policy targeting car makers, by way of subventions granted for the first 200,000 models sold by each one in the United States, but also drivers who are entitled to a rebate based on their income level. Other more indirect benefits are being rolled out, such as the option in Los Angeles to drive an electric car in lanes reserved for carpooling. Finally, in January 2018, California governor Jerry Brown signed a decree with a budget of $2.5 billion over 8 years to promote electric mobility.

Europe still looking for the best solution

European governments are also coming up with measures designed to encourage drivers to opt for electric vehicles. Generally, by regularly lowering average emission levels for new vehicles, the European Union imposes a sort of hidden quota system designed to influence car maker strategy. In Norway, there are several financial incentives in place for drivers: tax exemption on imported electric cars and sales tax, free toll passage and ferry crossings, driving in bus lanes, etc. These incentives make the electric car cheaper to buy and to use than the internal combustion engine. With the country also enjoying low electricity rates, the government target of 100% sales as of 2025 does not seem so utopian.

Other European countries are opting for a ban on internal combustion engines: by 2040 for the United Kingdom and France. To prepare for this deadline, the French government has already set up a system to reduce the purchase price which can represent up to 1/3 off the cost of an electric car. And a conversion premium—which may be doubled for French households on low incomes from January 1, 2019—is also available in certain circumstances. But the actual results of these measures may not really be felt before several months.

Increasingly high-performance lithium-ion batteries

Despite all these policies, the lithium-ion battery and its performance, in terms of range, charging time and life cycle, still seem to be an obstacle to wide-scale adoption of the electric vehicle.

However, from the lead-acid batteries of the early 1980s to the nickel-metal hydride batteries at the end of the 1990s, as yet, no technology has been able to match the lithium-ion battery’s performance. And its introduction in the automotive sector—initially on the Tesla Roadster in 2008, then on the Nissan Leaf in 2010—marks the real beginnings of the rise of the electric car. Since then, engineers have been working tirelessly to optimize its performance.

Range, life cycle and charging time are the key issues

The challenges are considerable. First of all there is the essential issue of range, which scientists refer to as energy density. “The psychological threshold is around 300 km”, estimates a Renault expert. In the future, for an equivalent price, the capacity of the batteries in the Nissan Leaf and other models should exceed 60 kWh for a range of around 400 km. But with current capacities at around 30 kWh, the range of the lithium-ion batteries in the most popular models actually rarely exceeds 150 km. Indeed, external conditions and driving habits have a direct impact on these performances.

The age of the electric car also needs to be taken into account, because the life cycle of lithium-ion batteries is not infinite. They lose capacity as mileage increases. This is a problem that engineers are specifically working on in order to reduce the costs of the electric car in terms of mileage. Already, the Tesla model S would only lose 1% of its storage capacity every 45,000 km. This way, the symbolic level of 20% loss would only be reached after… 780,000 km!

Another closely related challenge: charging time. This is still too high as far as drivers are concerned. Generally it still takes several hours, except for the most modern batteries which can be connected to an ultra-fast charging station and recover a range of up to 250 km in only 20 minutes. And in the coming months car makers are aiming to be able to charge an electric car battery to 80% in 15 minutes, keeping in mind that increasing the charging speed can cause alterations which reduce the life cycle of lithium-ion batteries.

Optimizing lithium-ion battery performance

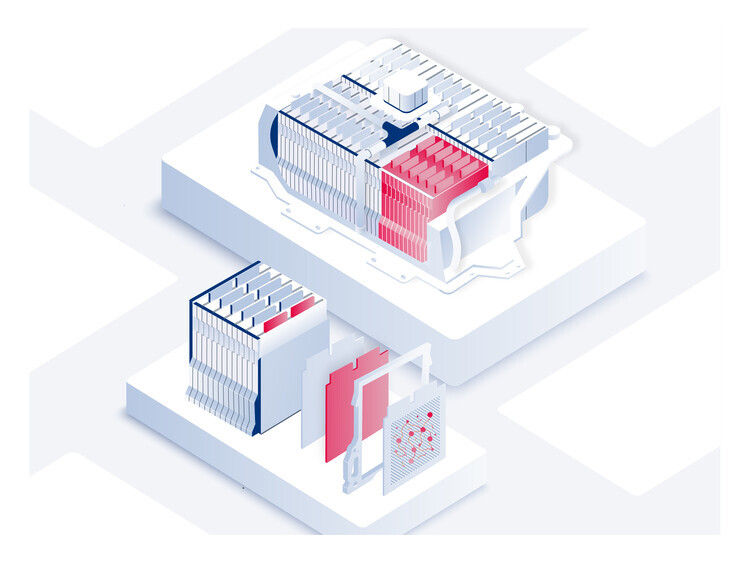

To boost lithium-ion performance still further, engineers can work on several components. A lithium-ion battery, or more exactly a battery cell, is first and foremost two electrodes, a sort of current collector covered in active materials, binders and various additives. It also has a porous plastic composite separator positioned between the electrodes to prevent them from touching. Finally, the cells are filled with liquid electrolyte made up of lithium salts—the sources of the ions—dissolved in solvent.

As far as the electrodes are concerned, innovative binders have been developed such as the one proposed by Arkema which has developed special grades of Kynar® polyvinylidene fluoride (PVDF) resins. They offer particularly high electrochemical stability, thus helping to improve the stability of the battery’s performance. “Even when present in small quantities in the formulation, they ensure an essential adhesion function for active materials among themselves and on the electrode collectors. And this way they provide access to higher energy density and therefore greater range”, says Thomas Fine—Global Market Manager Battery for technical polymers at Arkema

Work is also being done on the formulation of the electrolyte (a lithium salt-based solvent) which plays an essential role as source and transport medium for the lithium ions between the two electrodes. A new generation of lithium salts developed by Arkema is more stable. In particular, this helps delay loss of performance in lithium-ion batteries and improves the charging time without risking damage to the battery.

Another ongoing innovation: improve the electrical conductivity of the electrodes using carbon nanotubes. As manufacturers of carbon nanotubes, Arkema is working in this field to obtain ultrapure carbon nanotubes which are therefore perfectly stable in the battery. At the same time, “increasing the nickel content in the cathodes and introducing silicon in the anode could also improve energy density in existing batteries”, according to the Umicore manager.

Some experts believe that all these expected future innovations in lithium-ion batteries now leave little room for any alternative technologies. Replacing lithium-ion batteries with their track record and increasingly higher performance levels will be a real challenge for anyone promoting a new technology.

An alternative to lithium-ion batteries?

Certain car makers are wagering on a breakthrough technology and setting their sights on ranges of nearly 700 km, charging times of a few minutes, weight gains and lower production costs. New material combinations are being explored: lithium-sulfur batteries, lithium-air batteries, magnesium-ion batteries or even batteries using the astonishing properties of graphene. Each one is supposed to provide a solution to the problems still encountered by lithium-ion batteries.

The revolution of the solid-state battery?

One of the more credible solutions is that of the solid-state battery. “This is the main focus of our work in R&D”, stated an expert from Renault. Whereas in today’s lithium-ion batteries, the ions move from one electrode to another via liquid electrolyte, in solid-state batteries, this liquid would be replaced by a solid inorganic component.

Such a battery would, by nature, be considerably safer than the liquid electrolyte battery. It would also be less heat sensitive. Consequently, it would withstand more powerful and therefore faster charging. And with no need for a generally expensive cooling system, it would be cheaper and more compact than a similarly-sized lithium-ion battery and thus able to store two to three times more energy.

It is up to the scientists to develop new types of binders and additives and to select the high-capacity or high-voltage active materials that can nudge the intrinsic performance of solid-state batteries just that little bit further. There is talk of battery packs with capacities of 1MWh! US car maker Fisker has already announced the development of such a battery, promising a range of 800 km for a charging time of only 1 minute. Mass production could start in 2023. Toyota has promised its own version of the solid-state battery before 2025.

An infrastructure to prepare

At the same time as actual battery innovations, an entire infrastructure will need to be overhauled if we are to see more electric cars on the road. This is because future high-capacity batteries will require ultra-fast charging stations of up to 350 kW—compared to only 50 kW for standard stations. And a number of reservations have already been expressed about the capacity of the electricity grid to meet this new demand. “The main focus needs to be on multi-vehicle charging stations. Charging 100 electric cars or buses at the same time requires energy levels which may not be available on the grid”, explains Laurent De Vroey. The expert believes that intelligent charging solutions will be put in place—for example, a driver will connect his or her car on their company’s parking lot on arriving at work in the morning and the system will manage, in the background, shared charging between his or her car and the other employees’ cars so that everyone has a fully charged battery when they leave, without putting excessive demands on the grid. “Especially if they are connected to local renewable power sources.”

So rather than seeing the electric car as a problem for the grid, others see it as a genuine asset. In Japan for example, following the Fukushima accident, the authorities promoted electric car batteries as anti-blackout systems, capable of controlling or even replacing the grid in the event of a major incident. In Europe, pilot projects are already in place that use them to support the grid during peak periods. “But even if certain car makers already see this as a game changer, these solutions have not yet reached maturity”, says Laurent De Vroey.

Electric cars: genuinely clean solutions?

The benefits of using electric cars cannot be denied: silent and with no exhaust, they do not emit any CO2 while on the move. This is a major argument for authorities seeking to cut down on urban pollution. In Europe, the transport sector makes up virtually 25% of greenhouse gas emissions. It is the main contributor to urban pollution and electric cars seem to be the solution to this problem. Eckard Helmers, Professor in environmental science at the University of Trier (Germany) is not afraid of going further :

Wherever there is a high percentage of renewable or nuclear energy in electricity production, electric cars offer considerable advantages in terms of carbon footprint. Also because they are more energy efficient than the internal combustion engine.

In China however, nearly 70% of electricity is generated by coal-fired power stations emitting high levels of greenhouse gases. The large-scale use of electric cars therefore does not appear to offer any particular benefit in terms of carbon footprint.

Taking the global environmental footprint into account

But in order to assess an object’s real ecological footprint, we need to look at its life cycle as a whole. And in this respect, lithium-ion batteries have a certain impact on the electric car’s footprint, because they are currently produced mainly in countries with less than honorable energy mixes. This situation which can only improve, however. Still further upstream, one has to consider the environmental, health and safety problems caused by the extraction, in developing countries, of the precious metals found in these batteries, along with the concerns over their supply.

Recycling lithium-ion batteries

These concerns, which must be added to the purely environmental and health issues, support looking into the recycling of lithium-ion batteries. Some experts claim that 80 to 90% of these batteries could be recycled. In Europe, 50% recycling of their mass is already imposed by law. For the moment it is mainly standard industrial- and commercial-use metals including iron or copper, but also cobalt and nickel, that are recovered in this way. The sector still requires more organization, and an increasing number of batteries arriving on the market for recycling will of course be beneficial to it.

Some car makers also envisage a second life cycle for the lithium-ion batteries from their electric cars. “Whether it’s from an environmental or economic standpoint, we have to optimize the life cycle of our batteries”, says an expert from Renault. Because once their performance has dropped below an acceptable threshold, they could still be used as a storage solution for renewable energies. This is already the case in Amsterdam (Netherlands), in the Johan Cruyff Arena where several dozen Nissan Leaf batteries are used as a backup electricity storage system powered by solar panels. This is a fine example of how lithium-ion batteries in electric cars can become part of a circular economy.

Electric trucks and buses… the market takes off

And what if the age of the electric vehicle arrived first for utility rather than private vehicles? Because due to their weight and range lithium-ion batteries seem more naturally suited to utility vehicles restricted to urban journeys or scheduled routes. City planners already see new opportunities for future urban developments with buses entering shopping malls or hospitals and accessing areas up to now prohibited on account of the noise they generate.

So, despite the high costs involved for electric buses in comparison to internal combustion engines, the market is taking off, especially in the public transport sector. There were 385,000 electric buses on the world’s roads in 2017. And once again China is the market leader with 95% of all sales on its market in that year. Already 17% of the buses operating throughout the country run on batteries and nearly 10,000 new electric buses are delivered to Chinese cities every five weeks! Throughout the rest of the world, major cities are gradually switching to electricity. For example, London has set a target of 100% electric by 2037, and the Los Angeles fleet should reach 100% by 2030. In Paris, the RATP is aiming for 2025.

Things are changing in the trucking sector, too. For example, in March 2018 Tesla Semi, the first electric truck from Elon Musk, with a capacity of 36 tons, completed its first delivery. A 400 km journey on a single charge. Industrial production should start in 2019. At the same time, in Germany, Deutsche Post DHL now uses electric vans built on a Ford Transit chassis for downtown deliveries. The manufacturer has announced an annual production of 3,500 units on its Cologne site. Yet this is nothing compared to the 50,000 electric vans Chinese start-up Singulato Motors alone plans to assemble every year in the province of Hunan.