The Group delivered a solid financial performance in 2023 in a demanding macroeconomic environment, with €1.5 billion in EBITDA, in line with its full-year guidance, and excellent cash generation. Arkema expects EBITDA to grow in 2024, mainly weighted to the second half of the year with the ramp-up of its major projects and a gradual improvement in market conditions.

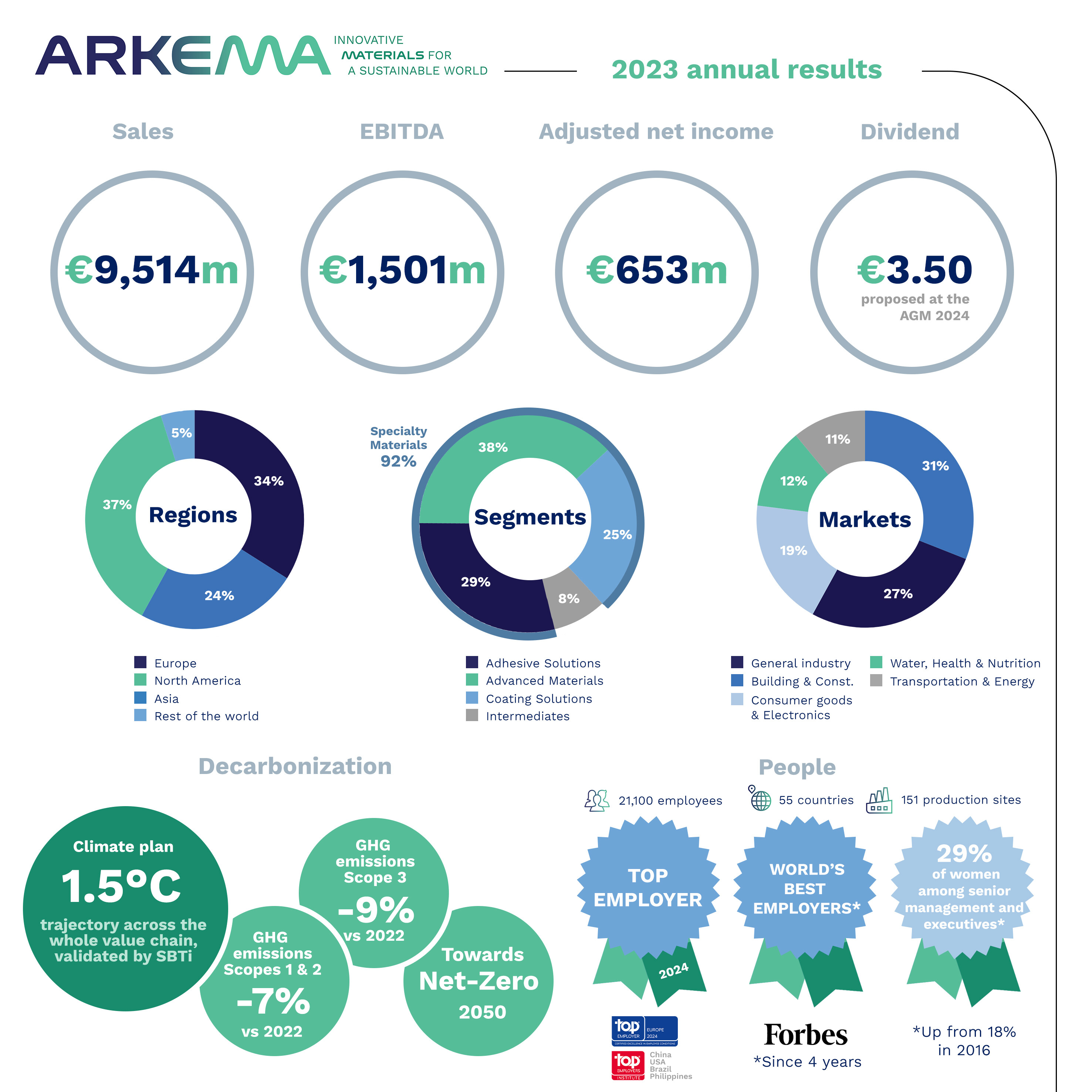

- Group sales of €9.5 billion, down 16.1% on 2022 at constant scope and currency:

- Volumes down by 10.0%, reflecting the overall slowdown in demand and destocking, although volumes were slightly higher in the fourth quarter relative to last year

- Positive dynamic in innovation-driven high performance solutions addressing sustainable megatrends

- Negative price effect of 6.1% reflecting lower prices for certain raw materials and the progressive price normalization of PVDF and upstream acrylics, which had benefited from particularly favorable conditions in 2022

- EBITDA at €1,501 million, down compared with last year’s very high comparison base (€2,110 million), and solid EBITDA margin in this context of low demand at 15.8% (18.3% in 2022). Q4’23 EBITDA up by 14% year-on-year to €331 million (€291 million in Q4’22), driven by the good performance of Adhesive Solutions and the resilience of the other segments

- Adjusted net income of €653 million, representing €8.75 per share (€15.75 in 2022)

- Excellent recurring cash flow of €761 million, reflecting the strict management of working capital and tight control of capital expenditure, and net debt of €2,930 million at end-December, representing 1.95x full-year EBITDA

- Proposed dividend of €3.50 per share (€3.40 in 2022), in line with the policy of a gradual increase, and corresponding to a payout ratio of 40%

- Finalization on 1 December 2023 of the acquisition of 54% of PI Advanced Materials, marking a key step in the strengthening of Arkema's very high performance polymers portfolio

- Continued progress in CSR performance with, in particular, reductions in greenhouse gas emissions of 7% for Scopes 1 and 2 and 9% for Scope 3 compared with 2022. Moreover, the share of women in senior management positions rose to 29% (26% in 2022)

- Outlook for 2024: the Group aims for EBITDA to grow in 2024 and reach between €1.5 billion and €1.7 billion. The start of the year should be in the continuity of the low demand of fourth-quarter 2023. EBITDA growth should be weighted mainly to the second half of the year with the ramp-up of the main growth projects from the second quarter onwards and the progressive improvement of market conditions.

Following Arkema’s Board of Directors’ meeting held on 28 February 2024 to approve the Group’s consolidated financial statements for 2023, Chairman and CEO Thierry Le Hénaff said:

“Arkema recorded a solid financial performance in 2023 in a particularly demanding macroeconomic context. I would like to thank our teams, who once again demonstrated their agility and unwavering commitment, enabling Arkema to deliver some important achievements in 2023, notably in terms of cash generation, CSR performance and the strengthening of the Group’s profile in Specialty Materials.

As 2024 has started in the continuity of the previous quarter, in a context of ongoing weak demand, we will continue to manage our operations tightly. We will benefit from the growing contribution, from spring onwards, of several major industrial projects in Asia and the United States, as well as from the integration of PI Advanced Materials’ activities.

In addition to managing the short-term, our teams are fully mobilized on our 2028 objectives which we unveiled at the Capital Markets Day last September.”

Outlook for 2024

In the first quarter, the macroeconomic context remains marked by a lack of visibility and soft demand in the continuity of fourth-quarter 2023. First-quarter EBITDA should thus be comparable to the fourth-quarter 2023 level and below the first-quarter 2023 level, which still benefited from favorable market conditions in PVDF and upstream acrylics, which progressively normalized during 2023.

Irrespective of a progressive rebound in demand, Arkema will benefit, starting in second-quarter 2024, from the ramp-up of several growth projects, which should contribute in the full year around €60 million to €70 million in terms of EBITDA. These projects include notably the hydrofluoric acid plant in partnership with Nutrien in the United States, the bio-based polyamide 11 unit in Singapore, the expansion of the Sartomer® plant in China and of the Pebax® plant in France, and the development of 1233zd fluorospecialties with low global warming potential. Arkema will also benefit from the contribution of the PIAM acquisition and from its associated growth synergies, in particular in the electronics and battery markets. Adhesive Solutions should achieve good growth in 2024, benefiting from the positive dynamic which started in second-half 2023.

Based on these factors, Arkema aims to achieve in 2024 a higher EBITDA, estimated at €1.5 billion to €1.7 billion depending on the level of recovery in demand, and with seasonality more weighted to the second half of the year.

Moreover, the Group will continue to implement its strategic roadmap unveiled at the Capital Markets Day of September 2023. It should notably confirm during the year its capital expenditure plan to support the growth of batteries for electric vehicles in the United States. It will continue to strengthen, in partnership with its customers, its innovation efforts in solutions for a less carbonized and more sustainable world, and pursue the implementation of its climate plan.

Further details concerning the Group’s 2023 results are provided in the “Full-year 2023 results and highlights” presentation and the “Factsheet”, both available on Arkema’s website at www.arkema.com/global/en/investor-relations/

The consolidated financial statements at 31 December 2023 have been audited, and an unqualified certification report has been issued by the Company’s statutory auditors. These financial statements and the statutory auditors’ report are available on the Company’s website at www.arkema.com/global/en/investor-relations/

Financial calendar

7 May 2024: Publication of first-quarter 2024 results

15 May 2024: Annual general meeting

1 August 2024: Publication of first-half 2024 results

6 November 2024: Publication of third-quarter 2024 results