· With sales of €11.5 billion, strong earnings growth in the year and excellent cash generation including the slowdown in demand in Q4

· Acceleration of opportunities in innovative materials for sustainable development

· Strengthening of the climate plan and further progress made in the CSR area

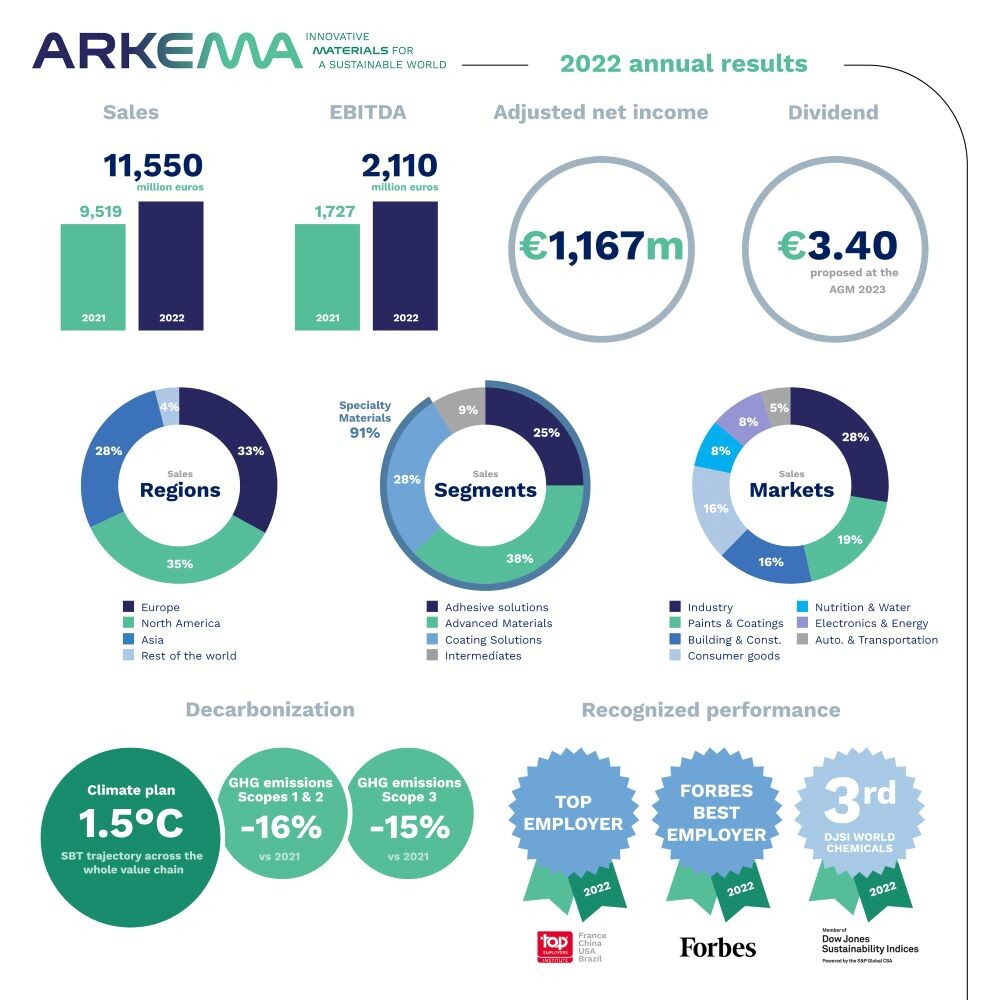

- Group sales of €11.5 billion, up by 21.3% compared with 2021:

- Organic sales growth of 13.6%, reflecting price increases in the face of significant raw materials and energy cost inflation and the improved product mix, as well as the slowdown in demand and significant destocking observed in the fourth quarter

- Acceleration in opportunities for innovative, high value-added solutions, particularly in low-carbon mobility, lightweighting, the circular economy and 3D printing

- EBITDA at a historic high of €2,110 million, up by a strong 22.2% year-on-year, and EBITDA margin at 18.3% (18.1% in 2021):

- Specialty Materials’ EBITDA up in each of the segments, to €1,900 million (€1,512 million in 2021) and Intermediates’ EBITDA stable at €306 million (€307 million in 2021)

- Q4’22 EBITDA at €291 million (€417 million in Q4’21), in line with the Group’s guidance and including the strong destocking at year-end

- Adjusted net income up by 30.2% to €1,167 million, representing €15.75 per share (€11.88 in 2021)

- Very high recurring cash flow at €933 million (€756 million in 2021), reflecting notably strict management of working capital

- Proposed dividend of €3.40 per share (€3.0 in 2021), in line with the policy of increasing progressively the dividend

- Continued progress in CSR performance, with in particular a 16% decrease in Scopes 1 and 2 greenhouse gas (GHG) emissions at constant perimeter and an increase in the share of women in senior management positions to 26% in 2022 (24% in 2021)

- Outlook for 2023: in a context at the beginning of the year marked by a lack of visibility and ongoing weak demand, and in the expectation of a progressive improvement in the economic environment from the spring, the Group aims to achieve in 2023 an EBITDA of around €1.5 billion to €1.6 billion and maintain a high EBITDA to cash conversion rate of over 40%.

Following Arkema’s Board of Directors’ meeting, held on 22 February 2023 to approve the Group’s consolidated financial statements for 2022, Chairman and CEO Thierry Le Hénaff said:

“Arkema achieved an excellent year in 2022 in many respects, first of all in terms of its financial performance, with EBITDA of over €2 billion, reflecting the efforts of all our employees, whom I would like to thank for their commitment in a demanding environment. We also finalized a high-quality acquisition, with Ashland’s adhesives, and entered the start-up phase at our production site in Singapore for polyamide 11 and its monomer, thus strengthening the Group’s profile, resolutely focused on innovative materials. It is also a great source of pride for the teams to be recognized by rating agencies as one of the leaders in our industry in terms of CSR.

2023 has begun in an economic context of weak demand, which requires us to be strict in managing our costs and working capital, while preparing for an improvement of the environment during the course of the second quarter. We have full confidence in the long-term prospects offered by our new developments focused on decarbonization and sustainable development, and we will continue to invest in these opportunities. We will leverage our cutting-edge innovation to continue to support our customers in their quest for sustainable performance.”

“Arkema achieved an excellent year in 2022 in many respects, first of all in terms of its financial performance, with EBITDA of over €2 billion, reflecting the efforts of all our employees, whom I would like to thank for their commitment in a demanding environment. We also finalized a high-quality acquisition, with Ashland’s adhesives, and entered the start-up phase at our production site in Singapore for polyamide 11 and its monomer, thus strengthening the Group’s profile, resolutely focused on innovative materials. It is also a great source of pride for the teams to be recognized by rating agencies as one of the leaders in our industry in terms of CSR.

2023 has begun in an economic context of weak demand, which requires us to be strict in managing our costs and working capital, while preparing for an improvement of the environment during the course of the second quarter. We have full confidence in the long-term prospects offered by our new developments focused on decarbonization and sustainable development, and we will continue to invest in these opportunities. We will leverage our cutting-edge innovation to continue to support our customers in their quest for sustainable performance.”

Outlook for 2023

At the beginning of the year, the macroeconomic context is marked by a lack of visibility and ongoing weak demand, in the continuity of fourth-quarter 2022. A progressive improvement is expected from the spring and should gather momentum in the second part of the year. In this demanding context, Arkema will draw on the responsiveness and commitment of its teams to adapt to changes in the macroeconomic environment and will continue to focus on cash generation and cost management.

Moreover, the Group will benefit from the contribution of its key expansion projects mainly in the second half of the year, namely the new bio-based PA11 plant in Singapore, the project with Nutrien in the United States, the PVDF units in China and France, and the expansion of the Sartomer® plant in China and the Pebax® plant in France, as well as from the ramp-up of Ashland’s performance adhesives.

In this context, Arkema aims to achieve in 2023 an EBITDA of around €1.5 billion to €1.6 billion and maintain a high EBITDA to cash conversion rate of over 40%.

Moreover, the Group is confirming its 2024 targets and will continue the implementation of its strategic roadmap and priorities, in particular its cutting-edge innovation focused on sustainable development and decarbonization, its targeted investments to increase its capacities and support its customers in high-growth markets linked to sustainable megatrends, its policy of high value-added acquisitions and its strategic review of the Intermediates segment.

Lastly, the Group will continue to act for a more sustainable world, leveraging its cutting-edge innovation in materials, responsible growth of its businesses, and its strong societal commitments.

Further details concerning the Group’s 2022 results are provided in the “Full-year 2022 results and outlook” presentation and the “Factsheet” document, both available on Arkema’s website at:

www.arkema.com/global/en/investor-relations/

The consolidated financial statements at 31 December 2022 have been audited, and an unqualified certification report has been issued by the Company’s statutory auditors. These financial statements and the statutory auditors’ report will be available in late March 2023 in the 2022 Universal Registration Document, which will be posted on the Company’s website at:

www.arkema.com/global/en/investor-relations/

Moreover, the Group will benefit from the contribution of its key expansion projects mainly in the second half of the year, namely the new bio-based PA11 plant in Singapore, the project with Nutrien in the United States, the PVDF units in China and France, and the expansion of the Sartomer® plant in China and the Pebax® plant in France, as well as from the ramp-up of Ashland’s performance adhesives.

In this context, Arkema aims to achieve in 2023 an EBITDA of around €1.5 billion to €1.6 billion and maintain a high EBITDA to cash conversion rate of over 40%.

Moreover, the Group is confirming its 2024 targets and will continue the implementation of its strategic roadmap and priorities, in particular its cutting-edge innovation focused on sustainable development and decarbonization, its targeted investments to increase its capacities and support its customers in high-growth markets linked to sustainable megatrends, its policy of high value-added acquisitions and its strategic review of the Intermediates segment.

Lastly, the Group will continue to act for a more sustainable world, leveraging its cutting-edge innovation in materials, responsible growth of its businesses, and its strong societal commitments.

Further details concerning the Group’s 2022 results are provided in the “Full-year 2022 results and outlook” presentation and the “Factsheet” document, both available on Arkema’s website at:

www.arkema.com/global/en/investor-relations/

The consolidated financial statements at 31 December 2022 have been audited, and an unqualified certification report has been issued by the Company’s statutory auditors. These financial statements and the statutory auditors’ report will be available in late March 2023 in the 2022 Universal Registration Document, which will be posted on the Company’s website at:

www.arkema.com/global/en/investor-relations/

Financial calendar

5 May 2023: Publication of first-quarter 2023 results

11 May 2023: Annual general meeting

28 July 2023: Publication of first-half 2023 results

27 September 2023: Capital Markets Day - Paris

9 November 2023: Publication of third-quarter 2023 results